LONDON, /PRNewswire/ - On 27 April 2022, the Board of Directors of Tetragon declared a dividend of U.S. 0.11 ( 11.00 cents) per share in respect of the second. On 27 July 2022, the Board of Directors of Tetragon declared a dividend of U.S. The company maintains two key business segments: an investment portfolio and an asset-management platform. Tetragon Financial Group Limited Dividend Information in Respect of Q1 2022. Tetragon Financial Group Limited Announcement of Dividend. The fund invests its entire corpus in Tetragon Financial Group Master Fund. Tetragon has released its Monthly Factsheet for August 2022. As part of this current investment strategy, the Investment Manager may employ hedging strategies and leverage in seeking to provide attractive returns while managing risk. Tetragon Financial Group Limited is a close ended feeder fund launched and managed by Tetragon Financial Management LP. It also seeks to use the market experience of the Investment Manager to negotiate favorable transactions.

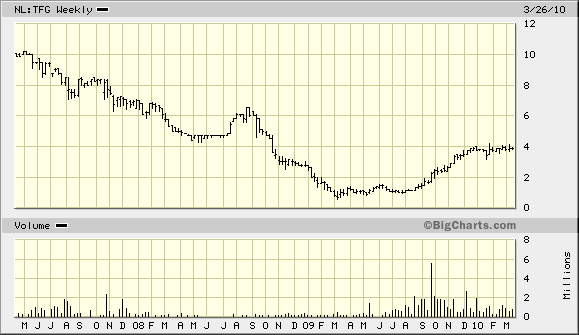

To achieve this objective, and to aim to provide stable returns to investors across various credit, equity, interest rate and real estate cycles, Tetragon Financial Management LP (the "Investment Manager") seeks to identify opportunities, assets and asset classes it believes to be attractive and asset managers it believes to be superior based on their track record and expertise. Tetragon Financial Group Limited (TFG) is a Guernsey closed-ended investment company traded on the NYSE Euronext in Amsterdam under the ticker symbol TFG. TFG's investment objective is to generate distributable income and capital appreciation. Fortress has a co-investment arrangement with Contingency Capital which could see it investing up to $500m in the funds and up to another $900m could come from an unnamed fixed income asset manager.Tetragon Financial Group Limited (TFG) is a Guernsey closed-ended investment company traded on the NYSE Euronext in Amsterdam under the ticker symbol "TFG" that currently invests primarily through long-term funding vehicles such as collateralized loan obligations in selected securitized asset classes and aims to provide stable returns to investors across various credit, equity, interest rate and real estate cycles.

The Companys investment objective is to generate distributable income. Tetragon’s initial provision of working capital, operational support and a $50m commitment to the first fund will get it a significant minority interest in Contingency Capital. Tetragon Financial Group Limited is a Guernsey-based closed-end investment company. Payment of the dividend will take place from 25 August 2022. 0.11 (11.00 cents) per share in respect of the second quarter of 2022.The ex-dividend date is 1 August 2022.The record date is 2 August 2022.Payment of the dividend will take place from 25 August 2022. 0.11 ( 11.00 cents) per share in respect of the second quarter of 2022. 8, 2022 /PRNewswire/ - On 27 July 2022, the Board of Directors of Tetragon declared a dividend of U.S. View Tetragon Financial Group (location in New York, United States, revenue, industry and description. He was also the co-founder and co-head of its Legal Assets group. Tetragon Financial Group Limited Announcement of Dividend. Contingency Capital will have its formal launch on 1 November 2020.īrandon Baer formerly worked at Fortress Investment Group where he was a partner and managing director in the Credit Funds business. Net Asset Value: 2,708mFully Diluted NAV Per Share: 28.74Share Price (TFG NA): 10.30Monthly. Tetragon providing finance to Contingency Capital – Tetragon Financial and its diversified alternative asset management business, TFG Asset Management, have entered into an agreement with Brandon Baer to invest in his newly-created company, Contingency Capital, a multi-product global asset management business that will sponsor and manage litigation finance related investment funds. 30, 2022 /PRNewswire/ - Tetragon has released its Monthly Factsheet for August 2022.

0 kommentar(er)

0 kommentar(er)